The Real Reason Why GPU Prices Are Still Insane (Even After Crypto Crashed)

How artificial scarcity, corporate strategy, and post-pandemic economics are keeping your dream build out of reach.

Intro

Remember when you could build a killer gaming PC without taking out a second mortgage? Yeah, us too.

For a brief moment, it looked like sanity was returning. Crypto mining slowed down, Ethereum moved to proof-of-stake, and scalper bots got less aggressive. Yet here we are — mid-range GPUs are still $500+, and “flagship” cards are brushing $2,000.

So what gives? Is it inflation? Is NVIDIA just flexing? Or is the market permanently broken?

Let’s break down what’s really going on — and why GPU prices are still wild long after the crypto boom died.

Crypto Was Never the Only Problem

The crypto bubble turbocharged demand — but it was more of a spotlight than a root cause.

Miners bought in bulk, yes. But that demand exposed structural weaknesses: limited production capacity, poor supply chain resilience, and lack of transparency from vendors.

Once crypto demand fell, the prices didn’t. Why? Because…

The “Luxury Product” Rebranding

NVIDIA and AMD have shifted their strategy: GPUs are no longer positioned as mass-market gaming tools.

Flagship cards are now “halo” products — marketed like Ferraris, not Fords. This isn’t just price gouging — it’s intentional brand elevation.

Lower-end models now look worse in comparison to push buyers upward.

“$799 is the new mid-range.”

— A sentence that would’ve sounded like a joke in 2019.

Fake Scarcity, Real Profits

Production yields and supply issues have largely stabilized, but pricing hasn’t corrected. Artificial scarcity is maintained by:

-

Controlling shipments to retailers

-

Limited stock at MSRP

-

Encouraging “premium” AIB (add-in board) variants with inflated price tags

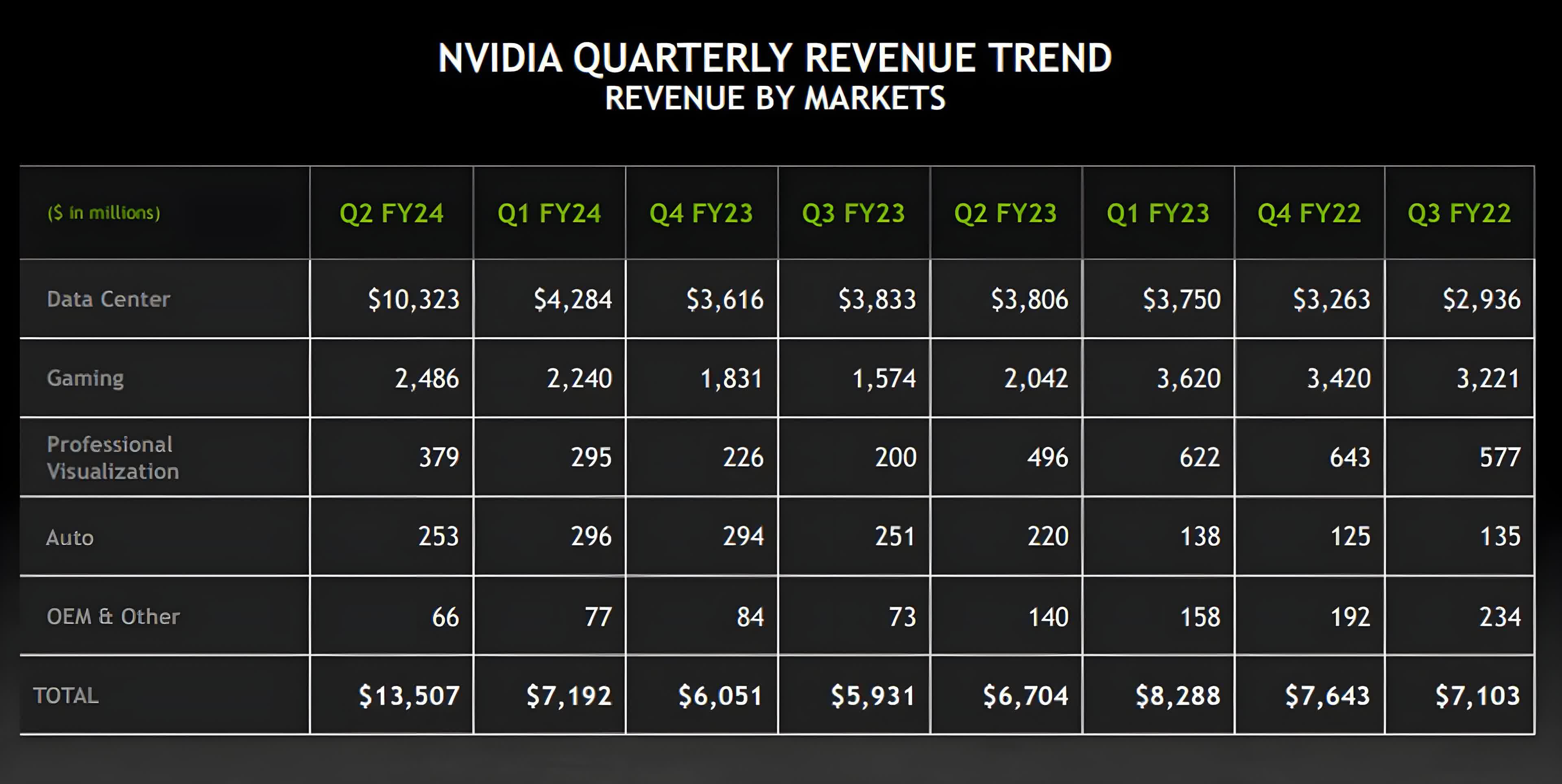

Meanwhile, record-breaking quarterly earnings keep rolling in.

Foundries, Costs, and TSMC’s Monopoly Power

TSMC dominates advanced chip manufacturing (5nm, 4nm, 3nm).

Their prices went up → NVIDIA/AMD’s costs went up → MSRP skyrocketed.

But: bulk contracts + economy of scale mean actual per-unit cost increases don’t justify the full retail hike.

Translation: yes, costs went up — but not that much.

The Used Market is Flooded — But There’s a Catch

Mining cards flood eBay after every crash, but many are:

-

Poorly maintained (VRAM temps through the roof)

-

No warranty

-

Questionable lifespan

Gamers burned by bad used GPUs are less willing to take the risk, pushing them back to new cards — even if overpriced.

The Anti-Consumer Future of GPU Pricing

NVIDIA’s pricing tier shifts look like a permanent change, not a temporary spike.

DLSS and frame-gen tech get locked to newer cards — even if older GPUs can technically handle it.

AMD and Intel are trying to compete on price — but they don’t have the same brand leverage (yet).

Conclusion: What Can You Actually Do?

-

Consider previous-gen cards — performance-per-dollar is better if you don’t chase the bleeding edge.

-

Watch for real price drops — not “$50 off $1,100 MSRP” nonsense.

-

Support competitive pressure — AMD and Intel need market share to push prices down.

Until we stop treating GPUs like luxury collectibles, the pricing insanity is here to stay.

Edited by Merzal#1414

0 Comments

Recommended Comments

There are no comments to display.

Please sign in to comment

You will be able to leave a comment after signing in

Sign In Now